TRX Price Prediction: Analyzing the Path to $0.50 Amid Mixed Signals

#TRX

- Technical support near $0.3356 with oversold Bollinger Band conditions

- Fundamental boost from 60% fee reduction and whale accumulation patterns

- Key resistance at $0.3513 (20-day MA) must be broken for bullish continuation

TRX Price Prediction

Technical Analysis: TRX Shows Mixed Signals Near Key Support

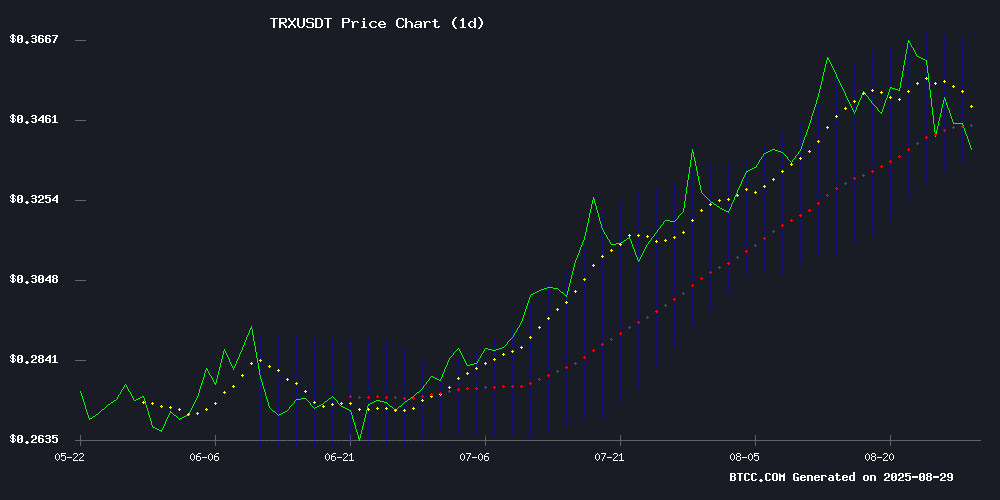

TRX is currently trading at $0.3373, below its 20-day moving average of $0.3513, indicating short-term bearish pressure. The MACD reading of 0.000324 remains positive but weak, while the signal line at -0.006303 suggests ongoing consolidation. According to BTCC financial analyst Olivia, 'The price hovering NEAR the lower Bollinger Band at $0.3356 indicates potential oversold conditions. A bounce from this support could target the middle band at $0.3513, though sustained selling pressure might test further downside.'

Market Sentiment: Whale Activity and Fee Reduction Boost TRX Prospects

Recent developments present a cautiously optimistic outlook for TRX. The implementation of a 60% fee reduction by Tron aims to stimulate on-chain activity, potentially increasing network utility. Whale-driven USDT flows suggest institutional interest, with some analysts predicting a rally toward $0.50. However, continued selling pressure remains a concern. BTCC financial analyst Olivia notes, 'While privacy-focused gambling adoption and whale accumulation are positive catalysts, TRX must overcome immediate resistance levels to validate bullish predictions. The broader cryptocurrency integration by U.S. institutions adds long-term credibility.'

Factors Influencing TRX's Price

Tron Implements 60% Fee Reduction to Stimulate On-Chain Activity

TRON blockchain has approved a sweeping 60% reduction in network fees, marking its most significant cut since launch. The decision, ratified by Super Representatives, takes effect August 29 at 20:00 GMT+8. Founder Justin Sun positions this as a strategic pivot to boost transaction volume across payments, transfers, and dApp interactions.

The move carries short-term revenue risks—projected at $28 million—but anticipates long-term gains through increased adoption. TRON will implement quarterly fee reviews, adjusting for TRX price movements and network activity. "This ensures sustainable validator economics while maintaining competitive accessibility," Sun noted during the announcement.

Top KYC-Free Casinos in 2025 Embrace BTC and USDT for Privacy-First Gambling

The rise of KYC-free casinos in 2025 reflects a growing demand for privacy and speed in crypto gambling. Players are bypassing traditional verification processes, opting instead for platforms that accept Bitcoin (BTC) and Tether (USDT) without requiring personal data. These casinos offer instant access, rapid withdrawals, and borderless operation—key advantages for crypto-native users.

Dexsport emerges as a standout in this space, operating as a decentralized Web3 casino and sportsbook. Supporting over 38 cryptocurrencies—including BTC, USDT, ETH, and SOL—it eliminates KYC entirely. The platform combines a 10,000-game library with multi-chain compatibility, appealing to users prioritizing anonymity and provably fair systems.

Whale-Driven USDT Flows Signal Potential TRX Rally Toward $0.50

TRON's TRX token is approaching a critical juncture as network activity surges and whale-dominated USDT transfers flood the TRON blockchain. The cryptocurrency currently trades near $0.3391, but market structure suggests a potential breakout toward $0.50 if current momentum holds.

Mega-wallets holding over $100 million in USDT accounted for 35-36% of daily balance changes on TRON this week, mirroring historical patterns where similar stablecoin movements preceded Bitcoin rallies. On August 12, a $3.9 billion transfer by these whale wallets coincided with Bitcoin's 5% surge to all-time highs.

The TRX price chart now reflects this stablecoin-driven momentum, with activity strongly correlated to Bitcoin's recent rebound toward $110,000. Market analysts observe that TRON's growing institutional flows may provide the liquidity needed for sustained upward price action.

TRON Faces Continued Selling Pressure Amid Key Support Test

TRON (TRX) slides 1.19% to $0.3440 as bearish momentum persists, with market capitalization dipping to $32.56 billion. Trading volume contracts by 19.07% to $825.25 million, reflecting waning participation.

The $0.3439-$0.32 support zone emerges as critical infrastructure for bulls. A successful defense of this territory could catalyze a rally toward $0.433, while failure risks accelerating declines. Technical indicators paint a conflicted picture: RSI nears oversold conditions suggesting potential rebound, yet MACD maintains its bearish divergence.

Market structure remains fragile with TRX trading below all key hourly moving averages. The token's ability to hold current levels may determine whether recent losses mark a healthy correction or the start of deeper retracement.

U.S. Government Anchors GDP Data on Bitcoin, Ethereum, and Solana

The U.S. Department of Commerce has taken a groundbreaking step by publishing official GDP figures on public blockchains, including Bitcoin, Ethereum, and Solana. This move ensures digital permanence and universal accessibility, leveraging cryptographic hashes to guarantee data integrity.

July 2025's GDP growth rate of 3.3 percent was shared not as a full document but through tamper-proof hashes, allowing verification via public infrastructure. Oracle networks like Chainlink and Pyth facilitated cross-chain distribution, while major exchanges such as Coinbase and Kraken integrated the data for real-world applications.

The initiative marks a paradigm shift in government transparency, embedding economic metrics like the PCE Price Index into decentralized systems. Solana's tweet highlighting Pyth Network's verification role underscores the collaborative nature of this onchain milestone.

Kraken Selected by U.S. Commerce Department to Publish GDP Data on Blockchain

The U.S. Department of Commerce has partnered with cryptocurrency exchange Kraken to launch a groundbreaking initiative that will record gross domestic product (GDP) data on public blockchains. Announced by President Donald Trump and Commerce Secretary Howard Lutnick, this marks the first time a G7 nation will leverage blockchain technology for distributing official economic statistics.

GDP information will be recorded on nine major blockchains, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Avalanche (AVAX), Stellar (XLM), Polygon (MATIC), and Tron (TRX). The move aims to enhance data transparency, immutability, and global accessibility. Kraken has onboarded the Department of Commerce as a client and facilitated cryptocurrency procurement to cover on-chain transaction costs.

"This is a landmark moment for both our industry and our country," said Kraken co-CEO Arjun Sethi. The initiative demonstrates how blockchain's core attributes—transparency, trust, and innovation—can revolutionize the dissemination of government data.

Is TRX a good investment?

TRX presents a speculative investment opportunity with balanced risk-reward dynamics. Current technical indicators show the token trading near oversold conditions at $0.3373, with potential support at the lower Bollinger Band ($0.3356). Fundamental factors include reduced transaction fees (60% cut) that may boost network usage, and growing adoption in privacy-focused gambling platforms using BTC and USDT. However, resistance at the 20-day MA ($0.3513) and ongoing selling pressure require monitoring.

| Metric | Value | Implication |

|---|---|---|

| Current Price | $0.3373 | Below 20-day MA, near support |

| 20-Day MA | $0.3513 | Immediate resistance level |

| Lower Bollinger Band | $0.3356 | Key support zone |

| MACD | 0.000324 | Weak bullish momentum |

Investors should consider dollar-cost averaging and set stop-losses below $0.335 if pursuing long positions. The $0.50 target remains achievable but depends on broader market sentiment and TRON's ability to sustain on-chain growth.